The global workforce is entering an era of unprecedented change. Companies, particularly in the financial services sector, are grappling with persistent talent shortages, rapid technological disruption, and evolving employee expectations. Economic uncertainty, demographic shifts, and the increasing adoption of artificial intelligence (AI) are reshaping the way organizations attract, develop, and retain talent.

While many employers pause hiring and restructure amid geoeconomics volatility, the long-term imperative is clear: organizations that invest in skills development, flexible work models, human-centric technology, and purpose-driven culture will emerge stronger, more resilient, and competitive in a rapidly evolving landscape.

1. Skills Over Credentials: Redefining Talent Acquisition

The era of degree-first recruitment is giving way to skills-first hiring, a trend accelerated by talent scarcity and technological disruption. Increasingly, companies are looking beyond traditional qualifications to identify candidates with transferable skills, adaptability, and a willingness to learn.

Why Skills-Based Hiring Matters

Financial services firms, for instance, face both a shortage of newly qualified talent and an oversupply of senior professionals. This imbalance has been exacerbated by disruptions in traditional training programs and the rapid evolution of job requirements. Programs like HSBC’s Accelerating Wealth Programme and ADGM Academy’s Artificial Intelligence in Finance programme demonstrate the effectiveness of hiring across industries and providing intensive reskilling opportunities.

- HSBC: Hires individuals with transferable skills from other sectors and trains them in banking-specific competencies.

- ADGM Academy: Professionals and institutions across Abu Dhabi and the wider MENA region participate in a comprehensive AI in Finance programme, covering AI technologies, ethical considerations, machine learning applications, and enterprise implementation, preparing the workforce for AI-driven transformation in financial services.

Organizations adopting skills-based hiring expand their talent pools, reduce dependency on formal degrees, and enable more inclusive recruitment strategies. The approach also allows firms to adapt quickly to emerging business needs and technological disruptions.

Insight: Skills-based hiring is no longer optional; it is a strategic lever to mitigate talent scarcity and future-proof the workforce.

2. Talent Crunch in the UAE: Scarcity and Paradox

The UAE finance sector faces a unique paradox: too many applicants but too few matches. A dataset of 23,739 job postings (June–July 2025) shows that while finance roles attract dozens of applicants, up to 26% are reposted due to mismatched profiles.

- Oversupply at mid-levels: Clerical and analyst roles draw 60+ applicants each, but few meet niche requirements like IFRS 9, ESG reporting, or AI-driven analytics.

- Undersupply at the top: Strategic roles—CFOs, compliance heads, and private bankers—face succession risks as experienced expats rotate out and local pipelines remain thin.

- On-site preference: Nearly 90% of roles remain on-site, limiting the pool as global finance talent increasingly prioritizes hybrid flexibility.

The drivers of this shortage include:

- Demographic shifts: An aging workforce leads to higher retirement rates, creating succession gaps.

- Complex skill requirements: As technology, regulation, and sustainability reshape work, roles increasingly demand highly specialized expertise.

- Stress and burnout: Financial services, among other sectors, are high-pressure industries, contributing to elevated attrition.

Insight: The UAE finance market illustrates the paradox of abundance without alignment. Solving it requires matching skills to demand, investing in local talent, and rethinking rigid work models.

3. Technology and AI: Transforming Roles, Not Replacing Them

Artificial intelligence and automation are reshaping how work is performed, the skills required, and the expectations employees have. From AI-powered financial analysis to predictive analytics in compliance, technology is both an enabler and a disruptor.

Opportunities and Risks

While AI promises efficiency and insight, several challenges must be managed carefully:

- Skill atrophy: Over-reliance on AI can erode human capabilities.

- Career stagnation: Employees may fear losing relevance if their roles become overly automated.

- Ethical and privacy concerns: AI deployment raises questions around bias, accountability, and data protection.

Organizations are responding with human-centric AI strategies, combining technology with reskilling programs to ensure employees remain valuable contributors. For example, banks are using AI not to replace staff but to enhance decision-making, match talent to roles, and optimize workflows.

Skills of the Future

Finance professionals now need a combination of technical expertise, strategic thinking, and interpersonal skills. Tools like Power BI, predictive analytics, and enterprise resource planning (ERP) systems are becoming essential, even for senior roles.

Insight: AI should be seen as a partner to human talent. The organizations that integrate technology responsibly and invest in employee upskilling will create future-ready, resilient teams.

4. Flexibility, Wellbeing, and Purpose: Redefining Work

Employee expectations are shifting. While flexibility remains important, autonomy over working hours and stress reduction now rank higher than location or even pay in determining job satisfaction.

Trade-Offs in the Modern Workplace

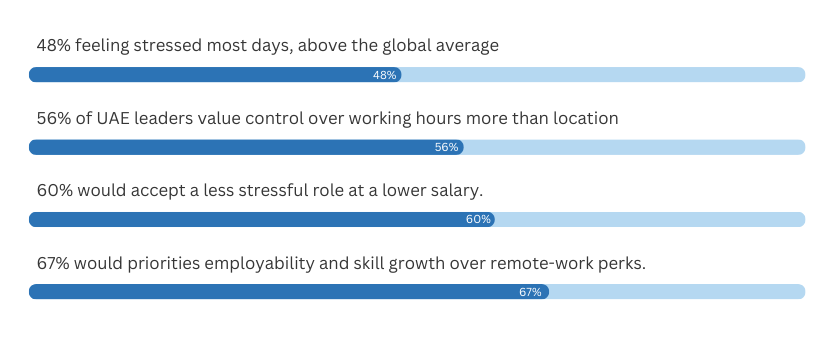

Research from Randstad’s Workmonitor and other 2025 reports shows:

These insights highlight a key trend: employees are willing to make trade-offs if organizations support their growth, wellbeing, and autonomy.

Implications for UAE Employers

- Focus flexibility on time autonomy — compressed weeks, flexible core hours, and custom schedules.

- Treat wellbeing as strategy, not a perk: invest in mental-health support, stress

- management, financial wellness, and purpose-designed office spaces.

- Provide visible growth paths through upskilling, mentorship, and career mobility.

- Build a values-led culture aligned with ESG priorities to engage younger talent.

Insight: Organizations that redefine flexibility and embed wellbeing into their culture will attract and retain top talent in a competitive labor market.

5. Global Talent Strategies: Thinking Beyond Borders

Talent scarcity is uneven globally. Countries differ in workforce availability, skill distribution, and demographic trends. Organizations increasingly adopt global, distributed workforce strategies, leveraging remote and hybrid teams to access the right skills.

Key Approaches

- Cross-border collaboration: Teams are increasingly global to fill skill gaps.

- Agile workforce models: Short-term projects, contract talent, and contingent workers provide flexibility in volatile markets.

- Diversity, equity, and inclusion: DEI initiatives are critical to attracting broader talent pools.

Insight: A global mindset in workforce planning is no longer optional. Organizations that leverage international talent, combined with upskilling, can mitigate scarcity and drive resilience.

6. Long-Term Transformation: Beyond Short-Term Caution

While many organizations are exercising caution—pausing hiring or restructuring—long-term transformation is essential. The post-pandemic, AI-driven landscape demands organizations rethink roles, culture, and workforce design.

Transformation Priorities

- Job redesign: Align roles with new skills, AI adoption, and evolving business needs.

- Purpose-driven culture: Embed shared values and ESG initiatives to engage employees.

- Learning embedded in business: Continuous, on-the-job reskilling and upskilling programs.

- Responsible AI deployment: Ensure technology augments talent rather than replacing it.

Organizations that approach transformation strategically—integrating talent, technology, and culture—will build resilient workforces capable of navigating uncertainty.

Retention Drivers

- Annual salary adjustments aligned with cost of living

- Managers who actively support career development

- Shared organizational values and meaningful work

- Sabbatical and caregiving support

Insight: Transformation is both a strategic necessity and a competitive differentiator. Companies that invest in human capital, skills, and culture will thrive in an era of disruption.

7. Actionable Recommendations for Employers

- Adopt skills-based hiring: Focus on potential and adaptability, not just credentials.

- Integrate AI responsibly: Use technology to enhance decision-making and efficiency while prioritizing employee development.

- Invest in reskilling and upskilling: Create continuous learning programs tied to career progression.

- Redefine flexibility: Emphasize autonomy over hours and stress reduction over location alone.

- Build a purpose-driven culture: Align organizational values with employee expectations and ESG initiatives.

- Think globally: Leverage distributed teams and cross-border collaboration to address talent gaps.

- Monitor workforce wellbeing: Track stress, burnout, and engagement to ensure high performance and retention.

Conclusion

The convergence of talent scarcity, technological disruption, and evolving employee expectations presents both challenges and opportunities. Organizations that invest in human capital, skills, and culture will thrive in an era of disruption. Partnering with a trusted finance recruitment agency can help businesses navigate this complex landscape, ensuring they attract, develop, and retain future-ready talent while staying competitive in a rapidly changing market.